Google searches for solar panels have rocketed by more than 300 per cent this year, with the cost of living and energy crises hitting hard. More Brits are looking for alternative and cleaner energy sources it has been shown by ...

People working from home are facing burnout, Zoom fatigue, and a lack of work-life balance, according to leading workforce analytics company, ActiveOps. This mistrust is driven by a lack of data, resulting in an inappropriate level of inclusion of remote ...

Six Scottish start-up businesses have secured a place in The Curiosity Shop, a new space at Virgin Hotels Edinburgh, dedicated to showcasing sustainable Scottish businesses. Created in partnership with Virgin StartUp, Virgin’s not-for-profit incubator for entrepreneurs, The Curiosity Shop features ...

Two old school friends, who took on high-profile entrepreneurs in the Dragons’ Den twice, are setting their sights on a £500,000 sales return for their new eco-friendly solution to serving up sauce. Ian Worton and Peter Neath are confident that ...

On this week’s edition of Moxie Indicator Minutes, TG goes through a few examples of how the market might continue before the 1-2 punch of a pullback and topping pattern. TG is seeing a ton of names that are in ...

One of the hardest parts of investing is changing your mind as the charts change, rather than waiting for the news and the economy to change. Before the CPI print, the market had been stalling sideways for almost two weeks. ...

In this special presentation courtesy of StockCharts TV‘s The MEM Edge, Mary Ellen reviews why select stocks are trading higher than the markets. She also highlights the rotation into Small Caps and shares ways to capitalize. This video was originally broadcast on ...

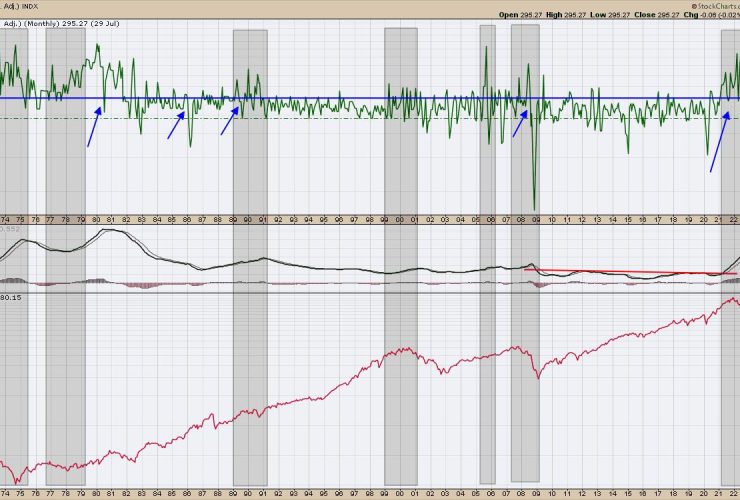

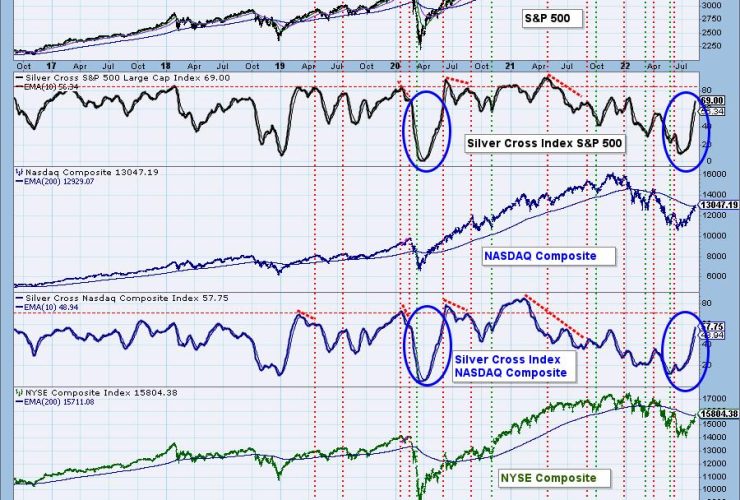

We decided to take a look at our Silver Cross Index (SCI) and Golden Cross Index (GCI) across the broad markets. They were startling, to say the least. As we all debate whether this is the end of the Bear ...

Since the initial rally off the June low, we’ve been reinforcing the importance of upside resistance in the 4150-4200 range. This is based on an initial Fibonacci retracement off the lows, and also happens to be the peak from early June. ...

Last week’s rally in the Nasdaq marked a 21% rise from its June 16th closing low and, according to widely-followed criteria, this signals the end of its bear market status. The gains occurred following news of a slight easing of ...